An investment’s internal rate of return (IRR) is how much the investor will make from their investment without accounting for external factors like the economy. In practice, IRR serves as a metric of profitability that allows investors, business owners, and financial analysts to compare investment options.

What Is the Internal Rate of Return?

The internal rate of return (IRR) measures the profitability of an investment. Calculating IRR gives an investment’s rate of return, or how much profit the investment will generate. However, the internal return rate doesn’t consider external factors like risk or inflation.

IRR is often used to choose between investment options by completing a form of discounted cash flow (DCF) analysis— the internal rate of return is the discount rate that would bring an investment’s net present value (NPV) to zero. An NPV of zero would mean the investment breaks even: the present value of all future cash flows equals the investment’s generated revenue, associated costs, and initial investment amount.

As such, IRR gives the yield rate, or the expected return on investment, shown as a percentage of the investment. For example, a $10,000 investment with a 20% IRR would generate $2,000 in profit. However, IRR is a type of compound annual growth rate, meaning the annual yield from the investment is reinvested (or compounded).

JPMorgan Investment Banking

Advise your client on a suitable investment option in this free investment banking job simulation from JPMorgan.

Avg. Time: 3 to 4 hours

Skills you’ll build: M&A screening, cross-team collaboration, company analysis, strategic rationale, M&A process understanding, modelling, DCF, presentation

Who Uses IRR?

Business owners and executives often use the internal rate of return to compare investment or project options. For example, let’s say a company is deciding between purchasing equipment for a limited run of a new product or investing the same amount into a different venture. They can compare each IRR to determine which is a better choice.

IRR is also commonly used in corporate finance settings, such as venture capital and private equity firms, when assessing potential companies to invest in. In the fixed income and equities area of investment banking, analysts may rely on the internal rate of return to understand a bond’s yield rate.

>>MORE: Learn the differences between venture capital vs. private equity.

NY Jobs CEO Council Financial Analyst

Analyze a company's financials as an analyst on the technology team in this free job simulation.

Avg. Time: 2 to 3 hours

Skills you’ll build: Financial analysis, critical thinking, problem solving, Excel, communication

How to Calculate Internal Rate of Return

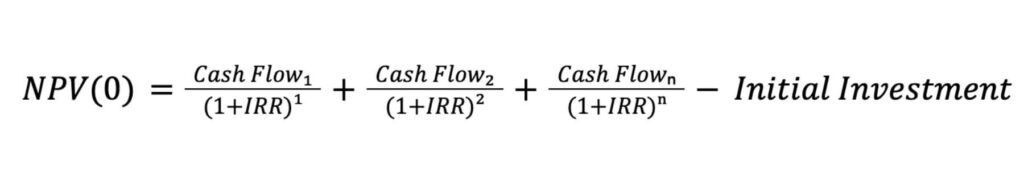

Calculating the internal rate of return uses the same formula as discounted cash flow (DCF) or net present value (NPV). However, in this calculation, the net present value needs to be set to zero. Instead of solving for NPV, the “x” we are solving for in the equation is the discount rate (typically signified as “r” in a DCF or NPV formula).

It’s important to remember that this is a type of compound annual growth rate, so returns from the investment are reinvested annually.

Internal Rate of Return Formula

In this formula:

- NPV is set to zero.

- Cash flows are the sums of money spent and earned on the investment for a given period of time (e.g., monthly or annually).

- 1, 2, and n are the periods of time, with n being the number of time intervals.

- IRR is the internal rate of return.

- Initial investment is how much the investment costs upfront.

Components of IRR Formula

Net Present Value (NPV)

NPV is the sum of an investment’s future cash flows discounted to present value. This is set to zero for this calculation so we can find the rate of return (IRR) that brings the investment to a break-even point (when NPV equals zero).

Cash Flow

Cash flows are any money a company or investor spends on or earns from an investment. This includes inflows of cash for profits, revenue, or dividends and outflows for expenses, interest, or loan payments.

Number of Periods

The number of periods is how long the investment lasts. For example, a five-year project would have five time periods. In some instances, the number of periods defaults to 10 since that’s the average lifespan of a company. When calculating IRR, these time periods need to be steady intervals — monthly, quarterly, annually — because the internal rate of return is an average across all periods and cannot be easily adjusted to differentiate for time frames of different sizes.

IRR

This is the discount rate, or how much the cash flows need to be adjusted to bring them to present value. IRR is also the “x” we need to solve for in this formula.

Initial Investment

The initial investment is the upfront cost to start the project or investment. For example, if a company invests $10 million into new machinery for a limited run of products, that $10 million would be the initial investment and would need to be subtracted from the total discounted cash flows.

Find Your Career Fit

Learn what career path is right for you with our free quiz!

Example IRR Calculation

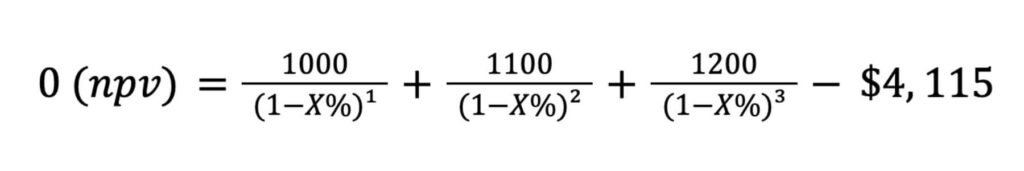

Calculating IRR by hand is a guessing game — you use trial and error to figure out which percentage rate results in a zero net present value. Let’s go through a simple calculation by hand using the following details:

- Initial investment: $4,115

- Cash flow for first year: $1,000

- Cash flow for second year: $1,100

- Cash flow for third year: $1,200

- Net present value: 0

So, with this information, we have this for a formula:

Generally speaking, it can’t be a very high rate of return since the initial investment is not very big and it’s only a three-year investment. Each discounted cash flow period (year one, year two, and year three) needs to be more than $1,000 to balance out the initial investment, so the IRR cannot be zero. To find the actual IRR, we need to plug different percentages in and see each NPV.

- If the IRR is 5%, the NPV for this equation would be -443. So, the IRR is not 5%.

- If the IRR is 15%, the NPV for this equation would be 537. So, the IRR is not 15%.

- If the IRR is 10%, the NPV for this equation would be 0. So, the IRR is 10%.

Luckily, IRR is rarely calculated by hand because it’s a time-consuming act of trial and error. Instead, finance professionals typically use an online or proprietary IRR calculator to determine an investment’s IRR. They may also use Excel using an IRR or XIRR function.

Interpreting the Results

Evaluating whether an internal rate of return is good or bad depends entirely on the company itself. Each company has a hurdle rate, or the minimum rate of return they need from an investment for it to be worthwhile. For some companies, their hurdle rate is the same as their weighted average cost of capital (WACC), while others may rely on the rate of return expected by shareholders.

Generally speaking, an investment would be worth pursuing if it has a higher IRR than the company’s hurdle rate. When comparing two options, companies usually choose the investment with the higher IRR.

However, IRR alone is often not enough to fully assess an investment option. Rather, finance professionals consider it in conjunction with other factors like the company’s risk tolerance, economic conditions, and the total duration of the potential investment.

Citi Investment Banking

Evaluate a prospective investment for your client with Citi's free investment banking job simulation.

Avg. Time: 5 to 6 hours

Skills you’ll build: PowerPoint, enterprise value, company research, Excel, financial modeling, forecasting, valuation, comparison analysis, critical thinking, reading comprehension

Showing You Understand IRR on Resumes

The skills section of your resume is a great place to mention IRR. Because IRR is a form of financial modeling and business valuation, you can also list it as a specific skill under those broader skill sets.

If you have prior work or internship experience that involved using IRR, mention a specific example in the description of the job or internship. For example, you can call out an instance when you calculated and compared the internal rates of return for two potential projects and how your analysis affected the company’s overall growth.

Additionally, your cover letter can be a place to discuss your experience with IRR outside of professional spaces. For instance, you can talk about how you compared personal investment options using specific metrics such as IRR and compound annual growth rates.

Related Skills

Business and finance professionals need a wide range of hard skills and soft skills to excel in their careers. Some skills similar to calculating IRR that these careers can benefit from include:

- Knowing when, where, and how to use financial models, like the capital asset pricing model (CAPM), in decision-making processes

- Understanding how to do a comparable company analysis

- Knowing how to calculate and use enterprise value

- Foundational knowledge of investing basics, like reading stock charts

Develop your skill set and get noticed by top companies with Forage’s free finance and banking job simulations.

Image credit: minervastock / Depositphotos.com