A company’s weighted average cost of capital (WACC) is the amount of money it must pay to finance its operations. WACC is similar to the required rate of return (RRR) because a company’s WACC is how much shareholders and lenders require from the company in exchange for their investment.

In this guide, we’ll go over:

- Understanding WACC

- How to Calculate WACC

- Difficulties With Using WACC

- Showing WACC Skills On Your Resume

- Related Finance Skills

Understanding WACC

Cost of Capital

To understand WACC, we need to know what the cost of capital is. Put simply, the cost of capital is how much a company needs to pay to finance operation. You can also think of cost of capital as the minimum amount the company can earn without defaulting on loans or upsetting shareholders. The cost of capital is the point where the company has made enough money to handle its current debt and equity responsibilities.

Cost of capital largely depends on how the company finances its operations. Most companies have a mix of debt and equity — some of the company is funded by loans, while the rest is funded by selling stocks or bonds to shareholders. A company can have one or the other, though, either running exclusively on debt or equity. Companies that finance through only one method have an easy time calculating cost of capital. For example, if a company finances with equity and shareholders expect a 15% rate of return on their shares, the company’s cost of capital is 15%.

Weighted Average Cost of Capital

When a company uses both debt and equity to fund operations, that funding mix is the company’s capital structure. These funding sources need to be weighted in WACC because debt and equity have different rates of return or different costs of capital.

So, the weighted average cost of capital looks at a company’s capital structure and compares equity and debt to their respective proportions of the capital structure. The debt portion typically involves the company’s interest rates and loan payments, while equity may involve dividend payments to investors. WACC is ultimately an average because certain aspects of the formula are not constant or exact. For example, determining the value of equity is tricky because market prices can fluctuate rapidly.

Who Uses WACC?

The weighted average cost of capital is a core metric used by investment bankers, private equity analysts, investors, and corporate finance team members like accountants. For example, in an investment bank’s mergers & acquisitions (M&A) side, analysts use WACC as part of business valuation practices, such as a discounted cash flow (DCF) analysis.

You can also use WACC on its own to determine if an investment is worth it. If the proposed investment has a lower rate of return than the company’s weighted average cost of capital, it may not be worth undertaking.

>>MORE: Learn how analysts use WACC in the real world with JPMorgan’s Investment Banking Virtual Experience Program.

How to Calculate WACC

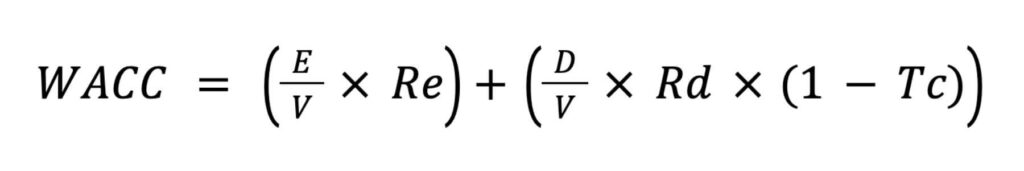

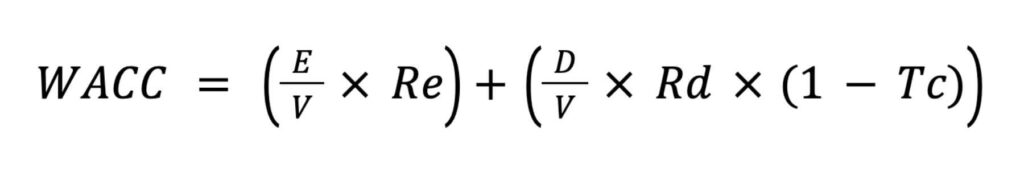

Calculating weighted average cost of capital requires comparing a company’s equity and debt to their respective proportions of the capital structure. Thus, the weighted average cost of capital formula has two parts:

- The first determines how much of the company’s capital structure is equity and then multiplies that by the cost of equity.

- The second part of the formula shows how much of the capital structure is debt and multiplies that proportion by the cost of debt.

WACC Formula

In this formula:

- E is the market value of the company’s equity.

- D is the market value of the company’s debt.

- V is the sum of the market value of the company’s debt and equity (E + D = V).

- Re is the cost of equity.

- Rd is the cost of debt.

- Tc is the corporate tax rate.

Components of WACC

Market Value of Equity (E)

The market value of equity is typically a company’s market capitalization or market cap. You can calculate market cap by multiplying the number of outstanding shares by the current share price. However, that approach only applies to public companies. The value of equity for private companies is typically estimated based on a comparable company analysis.

Market Value of Debt (D)

The market value of debt can be estimated using a company’s debt totals reported on recent balance sheets.

Cost of Equity (Re)

A company’s cost of equity is the minimum rate of return demanded by shareholders. This rate can be based on historical standards or shareholder agreements. However, many analysts use the capital asset pricing model (CAPM) to determine the cost of equity, as it considers the company’s risk tolerance and the overall market risk.

Learn more about the capital asset pricing model (CAPM).

Cost of Debt (Rd)

While interest rates on existing debt are technically the company’s current cost of debt, WACC is a forecasting calculation. Those interest rates may not represent the company’s future borrowing power.

Instead, using the average yield to maturity (YTM) on the company’s long-term debt is more accurate. YTM is the estimated total rate of return on a bond if it is held until maturity (when the debt is completely repaid). Cost of debt can also be estimated using the company’s credit rating.

Corporate Tax Rate (Tc)

The cost of debt needs to be adjusted to reflect that interest payments are tax-deductible. A company’s tax rate is primarily determined by where it operates. Some states and countries have lower tax rates than others. Additionally, tax rates can change periodically.

>>MORE: Learn more formulas you need for a finance career with Forage’s Investment Banking Skills Passport.

Example Calculation

Let’s imagine a publicly traded company that only operates in the U.S. with a market cap (market value of equity) of $15,000,000. This company’s debt has a market value of $6,000,000. Using the capital asset pricing model, we found that the company’s cost of equity is 16.5%, and based on the yield to maturity of the company’s debt, its cost of debt is 8%. Since the company only operates in the U.S., the corporate tax rate is a flat 21%.

So, we have the following details:

| Market Value of Equity | $15,000,000 |

| Market Value of Debt | $6,000,000 |

| Sum of Value of Debt and Equity | $21,000,000 |

| Cost of Equity | 16.5% |

| Cost of Debt | 8% |

| Corporate Tax Rate | 21% |

Using our WACC formula, we can start calculating each side of the equation — the equity side and the debt side.

Equity Side of Formula

$15M (market cap) / $21M (value of debt and equity) x 16.5% (cost of equity)

The weighted average cost of equity is: 0.117 or 11.7%

Debt Side of Formula

[($6M (value of debt) / $21M (value of debt and equity) x 8% (cost of debt) x (1 – .21 (tax rate))

The weighted average cost of debt is: 0.018 or 1.8%

So, the company’s weighted average cost of capital is: 0.135 or 13.5%

Interpreting the Results

In general, the higher the weighted average cost of capital, the riskier the company is to invest in. WACC is a percentage. The best way to think of that percentage is in terms of money. For example, if a company has a WACC of 5%, that means that for every dollar of financing (through debt or equity), the company needs to pay $0.05.

Determining a good weighted average cost of capital depends on the industry. Some industries, like oil companies, operate with more debt. More debt often means a higher WACC and a riskier investment. Younger companies and startups typically have high WACCs, too, since they are more likely to rely on debt as they grow toward profitability.

Find your career fit

Discover if this is the right career path for you with a free Forage job simulation.

Difficulties With Using WACC

Weighted average cost of capital is used widely throughout the finance industry, but that does not mean it’s without its faults. One major issue with using WACC is that the information required to calculate it is not always readily available. Because of this, individual investors may use simpler methods to measure the risk and value of an investment, such as the price-to-earnings (P/E) ratio.

Additionally, WACC is just an estimate, and not all aspects of the formula are consistent. Companies take on debt, pay off loans, sell shares, buy back shares, and tax rates change. These events all affect a company’s weighted average cost of capital.

Lastly, while WACC can be straightforward in theory, it’s ultimately very complex in practice. Large businesses often have many sources of debt, each with their own interest rates, and companies that operate in various states and countries will have a difficult tax rate to determine.

Showing WACC Skills On Your Resume

On your resume, you can mention WACC in two key areas:

- In the skills section of your resume, you can list WACC alongside other finance-related formulas or calculations you know, such as discounted cash flow (DCF) valuation, EBITDA, or the accounting equation.

- In the description of a job or internship, you can cite an example where you used WACC in a practical setting. For example, you can mention if you calculated WACC for several investment options to present to the company’s finance team.

Your cover letter is also a great place to talk about your experiences using WACC outside of work or internships. For example, mention if you’ve calculated the weighted average cost of capital as part of a school project or for your personal investing activities.

Related Finance Skills

WACC is just one tool used by finance professionals to evaluate companies and investment options. Other essential skills for a career in finance include:

- Understanding how to calculate and use enterprise value (EV)

- Knowing the fundamentals of the generally accepted accounting principles (GAAP)

- The ability to measure and evaluate profit margins

- Calculating compound annual growth rates (CAGR)

Expand your skillsets with Forage’s free finance virtual experience programs.

Image credit: Canva